top of page

Top 20 Personal Finance Tips

Here are 20 top personal finance tips for adults to help maximize their financial situation, each summarized briefly: 1. Create a Budget...

The Different Types of Life Insurance

Life insurance policies come in various types, each offering different features and benefits. Here’s a summary of the main types: 1....

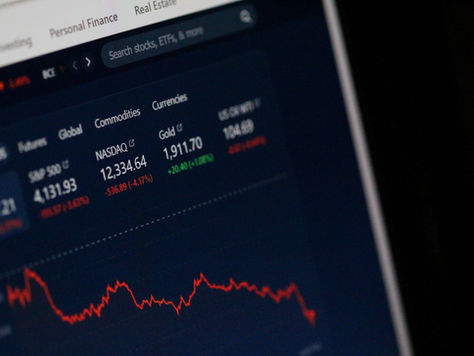

Top Investment Strategies for Long-Term Financial Growth

Building wealth over time requires a thoughtful and disciplined approach to investing. Whether you’re just starting out or looking to...

Debt Management 101: Strategies for Achieving Financial Freedom

Debt is a common part of modern life, but managing it effectively is crucial for achieving financial freedom. Whether you’re dealing with...

Maximizing Your 401(k): Tips for Growing Your Retirement Savings

Your 401(k) is one of the most powerful tools available for building a secure retirement. With tax advantages and the potential for...

Tax Planning Tips for Business Owners: Reducing Your Tax Burden

As a business owner, effective tax planning is essential to managing your financial health and ensuring that you're not paying more in...

Strategic Use of Credit: Leveraging Assets for Financial Growth

In the world of personal finance, credit is often viewed with caution. However, when used strategically, credit can be a powerful tool...

Decoding Financial Jargon: A Guide for Savvy Investors

Navigating the world of finance can be daunting, especially when you're confronted with a sea of jargon and technical terms....

Smart Budgeting for Financial Success: Tips and Tricks

Budgeting is one of the most fundamental aspects of financial success. A well-structured budget not only helps you manage your day-to-day...

The Power of Compound Interest: Building Wealth Over Time

Compound interest is often referred to as the "eighth wonder of the world," and for good reason. It’s a powerful financial principle that...

Understanding Your Risk Tolerance: A Key to Successful Investing

Investing is a powerful tool that can help you work towards building wealth and achieving financial goals. However, it comes with its...

Estate Planning Essentials: Protecting Your Wealth and Legacy

Estate planning is a critical component of financial management that ensures your assets are distributed according to your wishes, and...

What is Financial Planning?

Financial planning is the process of creating a strategy to manage an individual’s or organization’s financial resources effectively to...

What is a HELOC?

A Home Equity Line of Credit (HELOC) is a form of revolving credit where a homeowner can borrow against the equity of their home. Here's...

Your Credit Score: What It Is & Tips to Make It Excellent

What is a Credit Score? A credit score is a numerical representation of a person's creditworthiness. It’s based on the information in...

Understanding Emergency Funds

An emergency fund is a savings reserve set aside to cover unexpected financial expenses, such as medical emergencies, car repairs, job...

Types of Retirement Accounts

There are several types of retirement accounts, each with different tax advantages, contribution limits, and benefits. Here’s a summary...

Better Budgeting: A Step-by-Step Guide

Budgeting refers to the process of creating a plan for how you will spend and manage your money. It involves tracking income, expenses,...

Retirement Planning Overview

Retirement planning is the process of preparing financially for life after work. It involves determining retirement income goals and the...

Managing Personal Debt

Types of Personal Debt: During different stages of life, people may accumulate various types of personal debt. Understanding these debts...

bottom of page